How can we help

Our Solutions

Our range of heating and hot water solutions are designed with reliability, performance and energy efficiency in mind.

Training

We understand that you have a business to run, so we have training centres and satellite training centres throughout the UK so there’s not too far to travel.

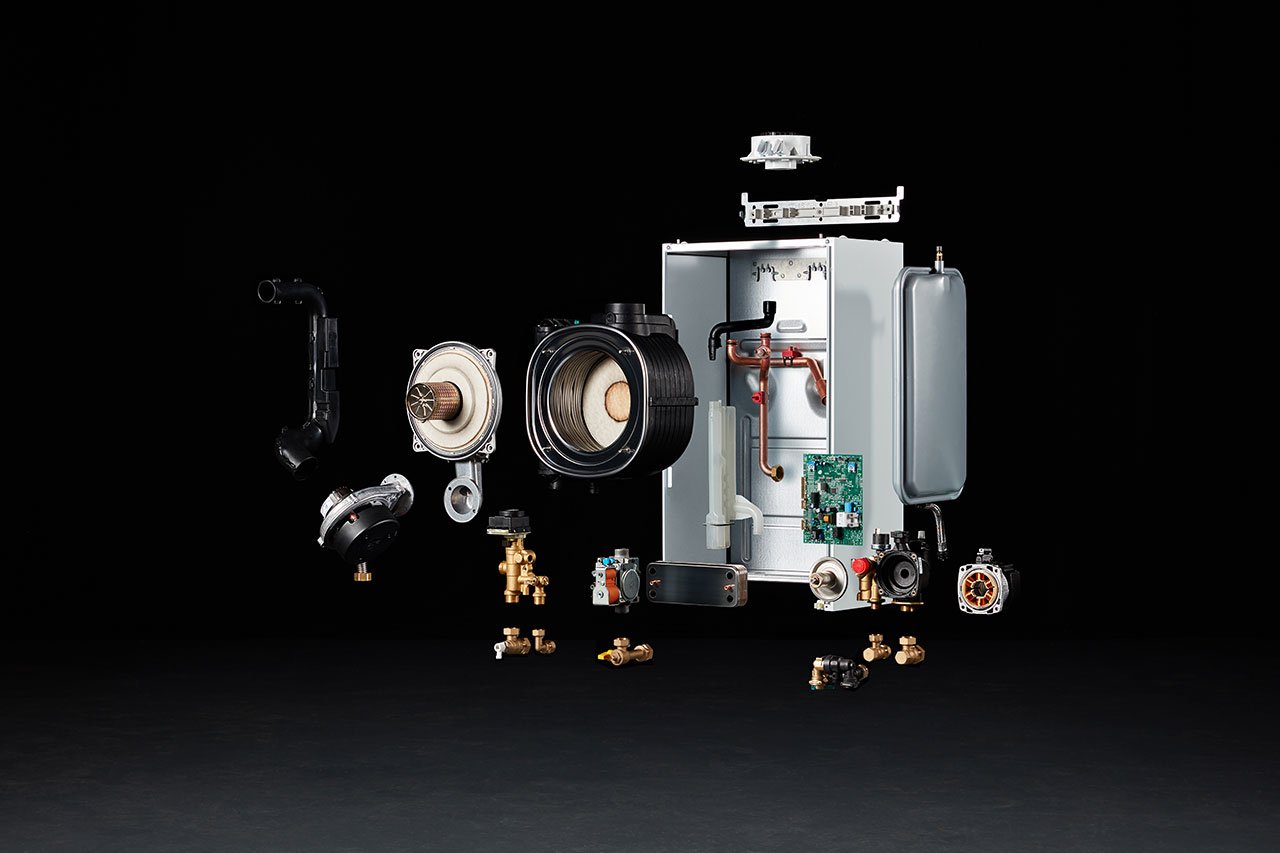

Baxi Genuine Parts

All Baxi Genuine Parts are rigorously tested and have been approved for use in our boilers, so we are proud for them to carry the 100% Baxi Genuine stamp of approval.

Error Codes

If a boiler develops a problem, it will display an error code. We explain the most common error codes here.

Heat Pumps

The UK government has set legally binding targets to achieve net zero greenhouse gas emissions by 2050, so the way we heat our homes, public and commercial buildings must change.

Our building stock varies greatly in the type, age, infrastructure, and the heating systems in them may be old and inefficient. So, at Baxi, we believe that a mix of different technologies will be required to address the challenge.

You need a full ASHP Solution We’ve got the lot

Baxi Works

It's easy to join and you can start reaping the benefits for your business straightaway and collecting points to spend in the rewards catalogue.

- Priority technical support and call outs

- Free Gas Safe notification and business support

- Exclusive content, including an extensive how-to video library

Contact your ASM

If you are a merchant or installer, your local Baxi representative is here to help.

Contact your Baxi Assure Representative

Our Baxi Assure Sales Team is on hand to help you with all your Residential Specification hot water and heating requirements.